Rufty-Holmes Senior Center helps make tax season a little easier for seniors

Published 12:05 am Sunday, February 19, 2023

- Post stated that they are unable to do out-of-state taxes, only North Carolina.

SALISBURY — Tax season is upon us. Even though it is no one’s favorite time of the year, it is still one of the most important.

For some, taxes can just be a hassle, but for others it can be a major financial burden. That is why Rufty-Holmes Senior Center is once again doing its part to offer free tax assistance programs for those who need it.

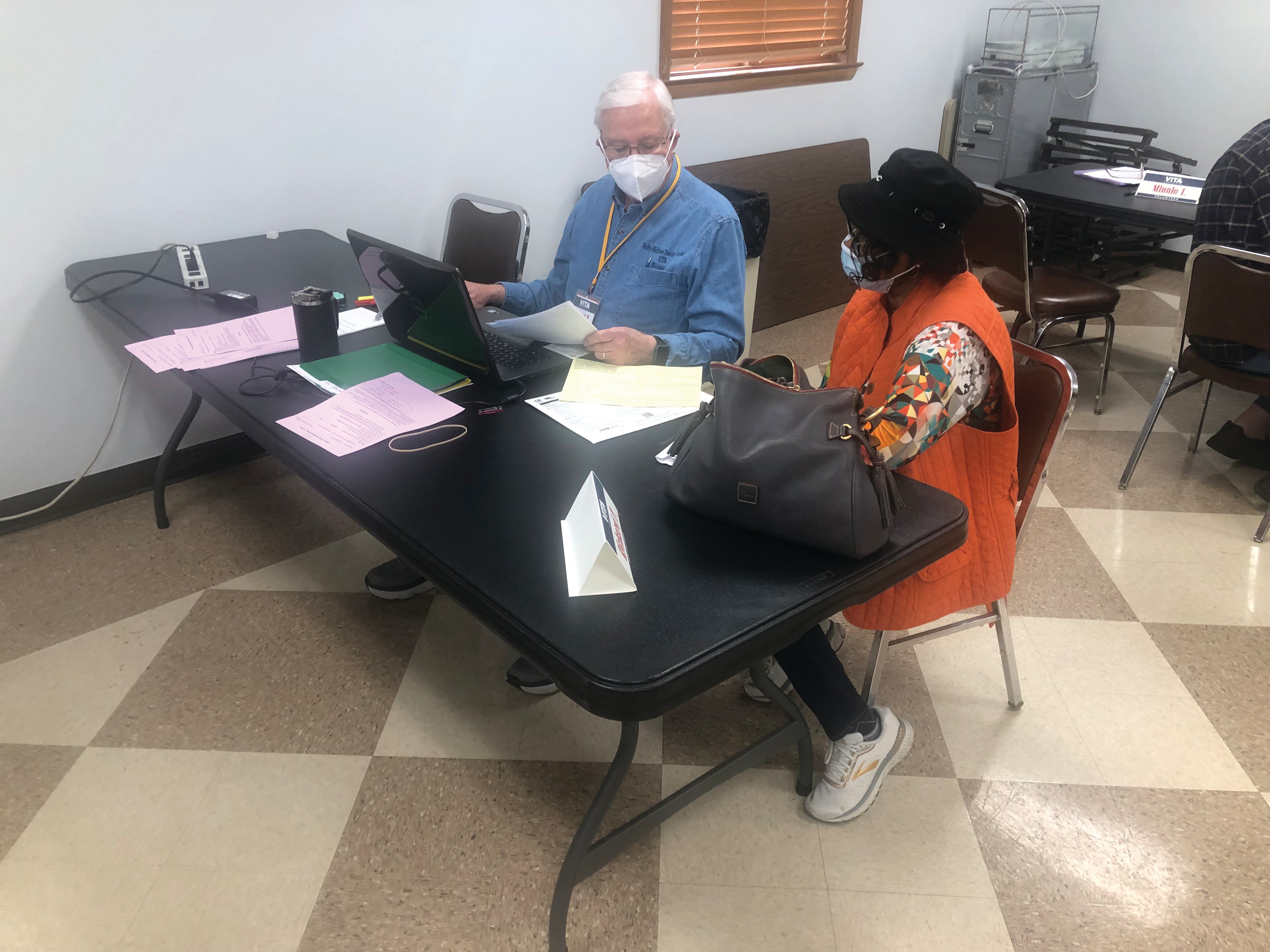

Rufty-Holmes has partnered with the IRS Volunteer Income Tax Assistance (VITA) program for weekly tax services through April 15. VITA has 9,000 sites nationwide with nearly 60,000 volunteers helping to prepare 2.25 million returns a year.

David Post, a member of the Salisbury City Council and board member at Rufty-Holmes, is the site coordinator for the first time this year. Having been a CPA for over 50 years, he has the experience and knowledge to make sure everything runs smoothly. Overseeing the program is a daunting task that not many others wanted to take on.

“These guys are great, but nobody wanted the pressure of it, the constancy of it, the all year round dealing with it. During tax season it’s pretty intense,” Post said.

This year is all in person after COVID affected how things were run the past few years. People will be asked to wear masks, but they do not need a proof of vaccination. The services are provided on Wednesdays and Thursdays during the day. The first step is to call Rufty-Holmes and set up an appointment. Post recommends people pick up a tax package so they will have all the necessary documentation, otherwise they will be turned away and will have to come back another day. In addition, no out of state taxes will be prepared, only those from North Carolina.

Once everything is accounted for, an intake person takes the materials to a preparer to log the person’s information into the computer. A quality reviewer will then look over everything a final time before it is time to check out. The whole process takes roughly two hours.

Despite having no true qualifications to receive tax assistance, the center caters to those who are more in need of the free service. “It’s aimed at moderate, low income and seniors,” Post said.

Everyone who works for the program is a volunteer and has to go through multiple tests and meetings to be able to show they have the knowledge to do the work. Pre-COVID, they did around 900 returns a year. Last year they did 700. This year they are hoping to get back to the pre-pandemic figures.

Post stresses that they need more volunteers to keep up with demand. He wants to spread services to other locations and become even more accommodating for those who come in looking for guidance.

“I want to go to several other sites and see how they operate because I met a lot of other site coordinators talking about how they did it. … I want to expand our service next year, I want to offer some night hours,” Post said.

Edward Klebaur has been volunteering for nearly 20 years and was the site coordinator last year, even though he does not have a background in taxes. The reason he volunteered is because of the gratitude that he receives from those he helps.

“My favorite thing is when the people say thank you because most people can’t afford this. That’s why we’re here, it’s free service,” he said. “Most people are afraid of the IRS and the fact that we take care of this job for them, it takes a lot of pressure off them. We’re giving back to the community, that’s the reward.”

Volunteers Steve Jones (left) and David Hord are among those helping taxpayers get everything put together correctly.