Appeal process begins as county residents receive property revaluation notices

Published 1:58 pm Wednesday, March 8, 2023

SALISBURY — County residents have started to receive their notices of property revaluation and can now start pursuing an appeal process if they think there has been a mistake in the assessed value.

When residents receive their notice it will say they have 15 days to make an appeal, but county officials have extended that to 30 days. Residents can call the Rowan County Tax Assessor’s office to make an informal appeal. The deadline for informal appeals is Friday, April 14, at 5 p.m.

If you think the assessed value is higher or lower than market value or if you think the assessed value is inequitable with similar properties, you can appeal. The majority of homeowners have seen values increase — some substantially.

Since the notices have gone out, more than 500 calls to the tax assessor’s office have come in from concerned residents who want to make an appeal or are curious about why the assessed value increased so much, county officials said.

Rowan County Tax Assessor Wendell Main said his office is going to work with everyone who wants to make an appeal or has questions. The office has 12 to 14 people answering phones to make sure every person gets the help they are seeking. Property owners who want to make an appeal can do so online, by mail, by phone or in person.

The first step of the appeal process is the informal appeals which is done by the tax assessor’s office; they will review the property and then contact the owner with a decision. If a resident is unhappy with that review they can make a formal appeal with the Board of Equalization and Review, starting in April. If still unhappy with that decision, a property owner can file an appeal with the Property Tax Commission.

If residents want information on their property’s market value, they can use the Comper Software the county has started to provide. This allows you to put in your name or home address and shows the market value of your house and neighboring houses. Real estate agents use a similar software. Residents can use this to help answer questions in the appeal process.

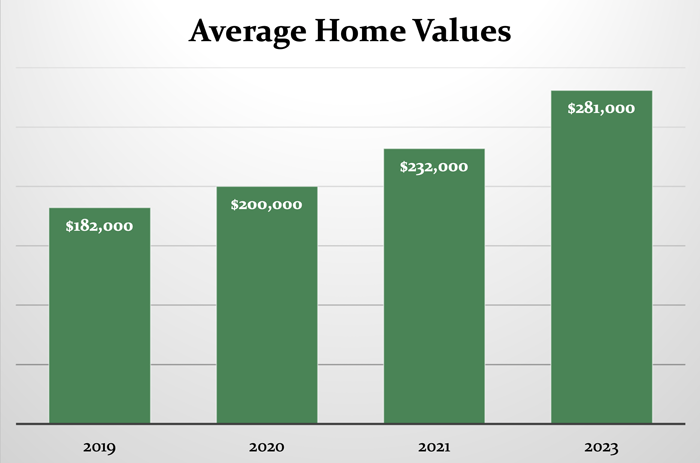

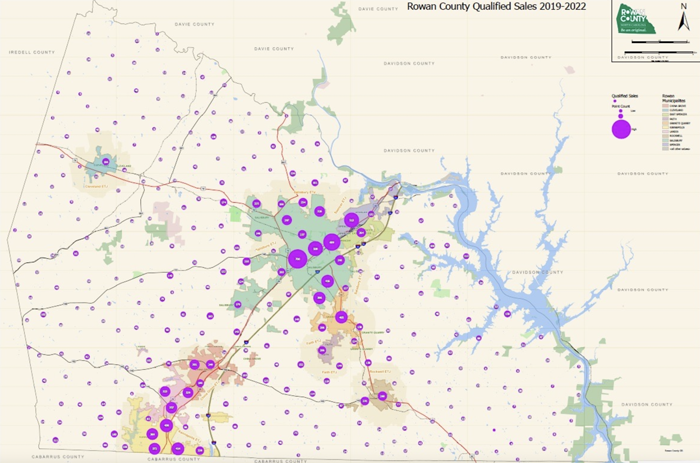

Real property values throughout the county have increased by 44.96 percent since the last revaluation in 2019. Rowan County Manager Aaron Church said it is the growth of the county and the surrounding Charlotte area that have caused such a dramatic increase. More than 2,000 new homes have been built in the county since the last revaluation. In 2019, an average home in Rowan County cost $182,000; in 2023 an average home was priced at $281,000 — a 54 percent increase.

“I can tell you in my career I have never seen a revaluation go up this much,” Church said.

Church also said that the increase “isn’t something unique to Rowan County.” Catawba County’s tax administration said average property values have increased 50 to 70 percent. The median increase for residential properties in Iredell County was 57 percent, according to the Charlotte Observer.

The revaluation process is required by law and is done every four years, the last being in 2019. For the past two years, Main and his team have assessed the value of over 80,000 parcels in the county to reflect fair market value as of Jan. 1, 2023. Those parcels are considered “real property” and make up 78 percent of the county’s tax base.

“There’s going to be a mistake. That’s a lot of parcels,” Church said. “We encourage everybody to call.”

The county will have a new tax rate in July. With an increase of this size from the revaluation, the tax rate should decrease, Church said.