Kannapolis given audit presentation for 2023 fiscal year

Published 12:05 am Friday, January 12, 2024

KANNAPOLIS — The Kannapolis City Council received their annual audit results for the 2023 fiscal year that ended on June 30, 2023, at their Jan. 8 work session meeting. Kari Dunlap of Martin Starnes & Associates, CPAs, P.A, the same firm that conducted Salisbury’s audit, led the presentation to council.

Dunlap said in the beginning that there was “an unmodified opinion on financial statements.”

“That’s the goal of the audit, that means there’s a clean opinion and there’s no reason to think that any of the numbers or material is misstated,” Dunlap said. “The audit is not an easy task. It lasts all year long, whether we’re on site or whether we’re in the office. We’re in constant communication…with getting everything completed.”

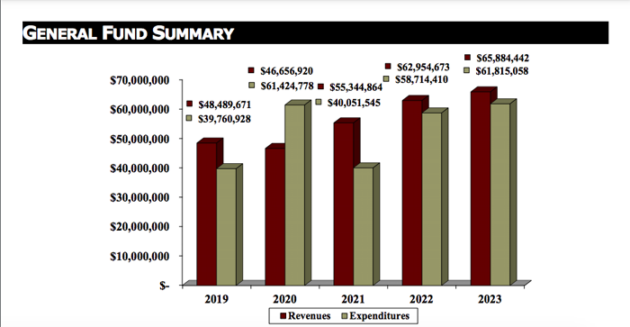

The general fund shows that revenues in 2023 were listed at $65,884,442 and expenditures at $61,815,058, a difference of $4,069,384. That figure is smaller than the difference in 2022 at $4,240,263, but the revenue and expenditure totals this year were greater than last year’s.

Dunlap noted the fund balance available as a percentage of net expenditures was 79.2 percent, which is beyond what the Local Government Commission requires.

“That’s a very high percentage. The LGC minimum for this is 25 percent and the median for similar units is 46 percent,” Dunlap said.

Net expenditures are calculated by combining total expenditures with transfers out and then subtracting debt proceeds.

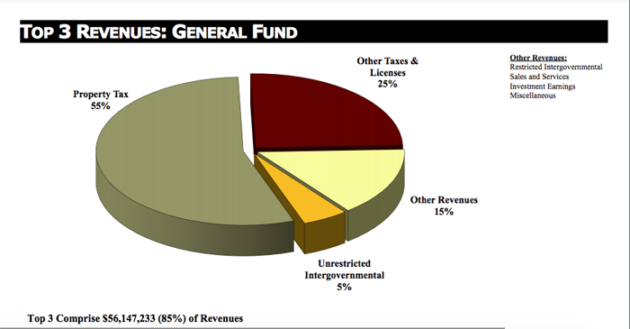

The city’s largest revenue generator came from property taxes, followed by other taxes, and then unrestricted intergovernmental. They made up 85 percent of 2023 revenues with $56,147,233 and all individually increased from 2022.

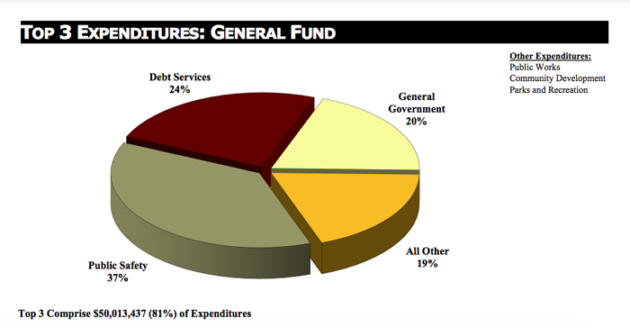

The highest expenditure Kannapolis invested in was public safety, followed by debt services, and then general government. Those categories consist of 81 percent of all expenditures, totaling $50,013,437. The city spent more on those three services than they did last year.

Cash reserves for water and sewer, stormwater, and environmental are significantly higher than their target reserve percentages.

Dunlap listed the “positive performance indicators” as being the high general fund available fund balance percentage, the enterprise fund quick ratios, and the stable property tax valuation and collection percentage.

Dunlap said the LGC wants the enterprise fund quick ratios to be above one and Kannapolis is “well above one…There’s no concern that you won’t be able to make debt payments or anything like that with your current assets.”

The stable property tax valuation and collection percentage also had “no issues” according to Dunlap.

“There was one audit finding and that was due to general statute that requires your funds to not be in a deficit and there were two capital project funds that did have a deficit, but we have discussed this and those have already been corrected for the fiscal year ‘24. There’s no issues that will be repeated.”

After the audit is approved by the LGC, the Annual Comprehensive Financial Report is going to be posted on the city’s website at a later date.